Contents

What is Grid Trading Bot

Grid trading bot is a trading program in which users can automatically buy low and sell high in a specific price range through the program. In the volatile digital asset market, the use of grid trading bots can avoid erroneous trading decisions caused by human factors to a greater extent. The grid trading bots will assist you in strictly implementing your own setting of low-buy-high-sell trading strategies.

Grid trading bot creation steps

- First log in to nextrendexchange.com, find “Grid Trading Bot” on the right side of the page, and then click the “CREATE” button

2.AI strategy: The system will automatically recommend the grid bot parameters that are most suitable for the current market based on the backtest data of the past seven days.

If you are using a grid trading bot for the first time, it is recommended that you can use the Nextrend Exchange AI strategy to help you formulate grid bot parameters. You only need to choose how much money to invest to create the grid trading bot.

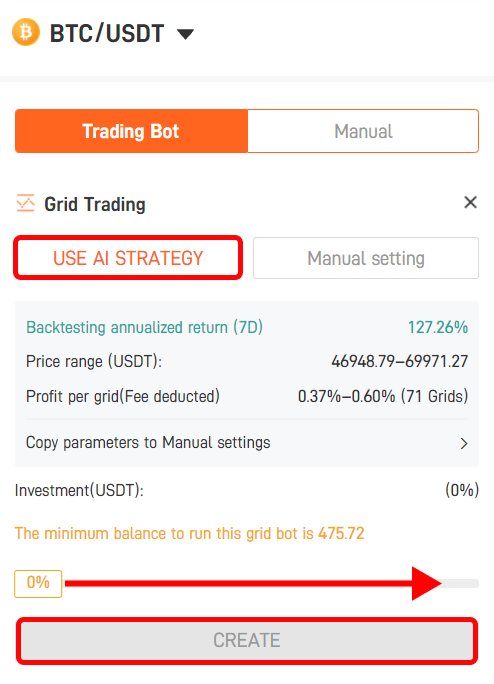

Steps for usage:Please click “USE AI STRATEGY” at the top left of the page, then slide the progress bar to the right to invest funds, and click to create an order.

3.Manual setting: If you want to set some personalized parameters, then you can set them through the manual setting mode.

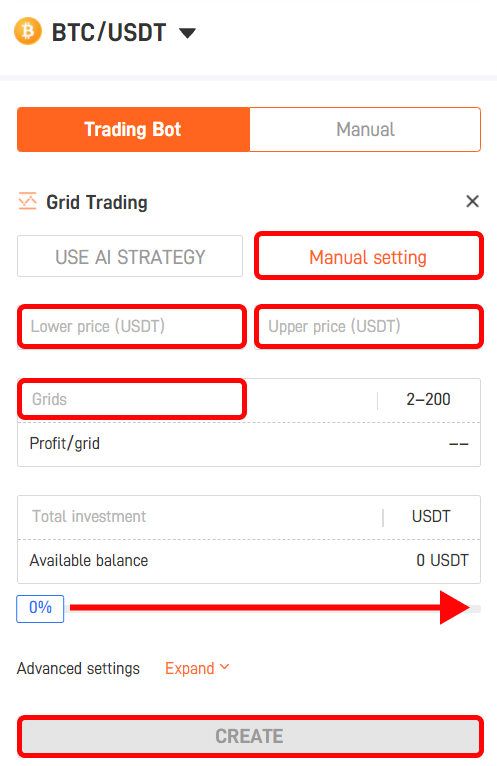

Steps for usage:Please click the manual setting in the upper right corner of the page, fill in the parameters such as the lower price , the upper price, and the number of grids in turn, and then slide the progress bar to the right to invest funds, and finally click “CREATE“. (If you need to set advanced parameters, you can expand the advanced settings area below to set the parameters)

Parameter meaning

- Upper price: When the price is higher than upper price, the program will no longer execute orders outside the grid interval.

- Lower price: When the price is lower than lower price, the program will no longer execute orders outside the grid interval.

- Grids: Divide the interval upper limit price and interval lower limit price into corresponding shares.

- Total Investment: The amount of cryptocurrencies planned to be invested in the grid strategy.

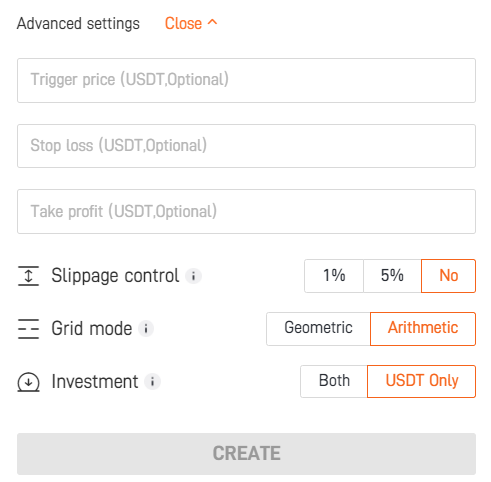

- Advanced settings: Advanced grid parameter settings, you can set by yourself or choose default system settings.

- Trigger price: When the currency price reaches this price, the bot order will be triggered and created. (For example, the current price of ETH is 3000USDT, and the trigger price is set as 2000USDT. When the price of ETH reaches 2000USDT, the bot order will be triggered and created)

- Stop loss: When the currency price drops to this price, the bot order will automatically closed and the spot locked by the bot program will be sold.

- Take profit: When the currency price rises to this price, the bot order will automatically closed and the spot locked by the bot program will be sold.

- Slippage control: To control the deviation of the final transaction average price of initial order and the price at the time of placing the order within a certain percentage range through parameter setting. (Due to the large volatility of the cryptocurrency market, when traders are trading, the final transaction price is often inconsistent with the price when the order is placed. At this time, you can control the slippage by opening the order limit price)

- Grid mode-Arithmetic: When creating a grid strategy, the price interval of each grid of the arithmetic grid is equal (for example, 1, 2, 3, 4)

- Grid mode-Geometric: When creating a grid strategy, the price range of each grid of the geometric grid is proportional (for example, 1, 2, 4, 8)

- Investment-USDT Only: Only use USDT to create the grid bot.

- Investment-Both: You can invest the dual coins in your account at the same time to create the grid bot (for example, when you select the BTC/USDT trading pair, you can simultaneously invest with BTC+USDT two cryptocurrencies to create the grid bot)

Example

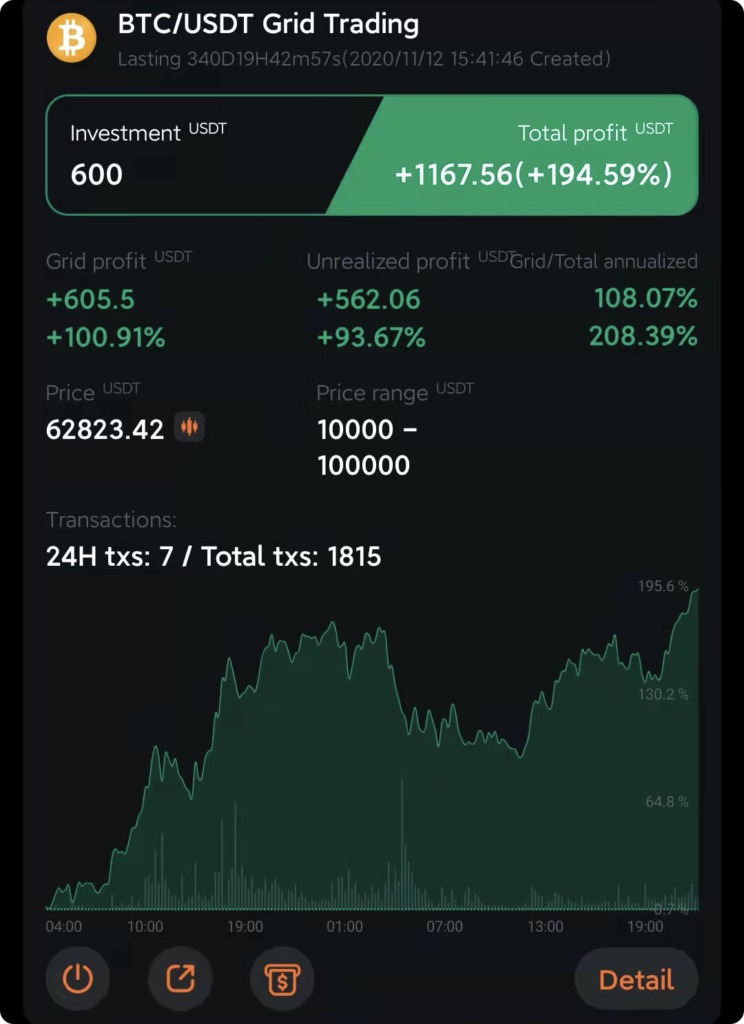

Take the BTC/USDT trading pair as an example, the setting parameters are:

Upper price: 100000 USDT

Lower price: 10000 USDT

Grids: 500

Grid mode: Arithmetic

Total Investment: 600USDT

The price of BTC/USDT while the strategy was created: 15883.83USDT

After the bot is created successfully, the order will buy a certain percentage of the spot at the current price and place sell orders above the current price; at the same time, bot will keep a certain percentage of USDT to place buy orders below the current price. The bot will continuously buy low and sell high within the price range, and accumulate the grid profit frequently.

When the price rises above 100000 USDT or falls below 10000 USDT, the strategy will be suspended. When the price returns to the price range, the strategy will resume the operation.

Explanation of bot Order Terms

- Investment: The amount of money invested when the grid bot is created

- Total profit: Grid profit + Unrealized profit

- Grid profit: Grid bot buys low and sells high to make profits from arbitrage

- Unrealized profit: (Current price-purchase cost) * number of tokens of bot held

- Grid annualized: [(Grid profit/investment)/(Lasting time/365)]*100%

- Total annualized: [(Total profit/investment)/(Lasting time/365)]*100%

The risks of grid trading bots

- If the price falls below the lower limit price of the interval, the order will not continue. When the price returns above the lower limit price of the interval, the order will continue. If the user sets the stop price, and the stop price is triggered. The grid strategy will be terminated.

- If the price exceeds the highest price of the interval, the order will not continue. When the price falls below the highest price of the interval, the order will continue. If the user sets the take profit price, and the take profit price is triggered. The grid strategy will be terminated. However, due to strategic reasons, you will miss the trading opportunities in this rising market of not having any positions.

- The use of funds is not efficient, because the grid strategy will place orders based on the price range and the number of grids set by the user. If the user sets the number of grids too small, and the price fluctuates at the two points (which two points are far away from each others) set by the user, the system will not automatically place orders.

- During the operation of the grid strategy, if the currency encounters unpredictable circumstances such as suspension or delisting of the currency, the grid strategy will be automatically suspended.