Contents

Why do you need Margin Grid

The Margin Grid is to mortgage your currency to borrow another asset to run the grid. It has a wide range of usage scenarios, not only suitable for fluctuation market but also for unilateral market.

How to understand? Assuming that ETH is now rising unilaterally, you create grid bot is not suitable at this time, and it is easy to rise out of the range. At this time, you can use the Margin grid to mortgage your ETH to borrow USDT, and use USDT to run the grid to make money. First of all, the ETH you pledged will not be sold because of the increase in currency price. Secondly, the USDT you borrowed will also earn grid profits due to the increase of ETH.

If the market is not good now and keeps falling, you can borrow ETH to run the grid, which is equivalent to short ETH. Grid will help you sell ETH at a high price and then receive it at a low price. Not only can you earn ETH through grid arbitrage, but because the price of ETH has fallen, the cost of returning ETH has also dropped a lot, making both arbitrage money and trending money.

Mortgage ETH to borrow USDT, the market will rise to make a profit, that is buying long.

Mortgage USDT to borrow ETH, if the market falls to make a profit, that is selling short.

How to use Margin Grid

First, please open the nextrendexchange.com website, then log in to your Nextrend Exchange account, then find the Margin Grid bot on the right side of the page and click the [CREATE] button on the right to enter the bot parameter setting page.

Explanation of Parameter

- Upper price: When the price is higher than upper price of the interval, the bot will no longer execute orders outside the grid interval.

- Lower price: When the price is lower than lower price of the interval, the bot will no longer execute orders outside the grid interval.

- Grids: Divide the interval upper limit price and interval lower limit price into corresponding shares.

- Margin: The amount of assets put into the bot for lock.

- Leverage setting: The bot can provide 0.2X, 0.5X, 1X, 2X, 3X, 4X leverage options.

- Borrowable fund: The total amount of funds available for borrowing on the current platform.

- Current daily interest: The real-time lending rate in the current market.

- Estimated liquidation price: If the currency price drops to the estimated liquidation price, the bot will perform a forced liquidation to control the risk.

Explanation of Advancing settings

Trigger price: When the currency price reaches this price, the bot order is triggered to be created. (For example, the current price of ETH is 4500USDT/unit, and the trigger price is set to 5000USDT. When the ETH price reaches 5000USDT, the bot order will be triggered to create).

Stop loss: When the currency price drops to this price, the bot order will be automatically closed and the assets borrowed by the bot will be returned.

Take profit: When the currency price rises to this price, the bot order will be automatically closed and the assets borrowed by the bot will be returned.

Slippage control: Through parameter setting to control the deviation of the initial open final transaction average price and the price at the time of placing the order within a certain percentage range. (Due to the large volatility of the crypto market, when traders are trading, the final transaction price is often inconsistent with the price when the order is placed. At this time, you can control the slippage by creating the order limit price).

Grid mode-arithmetic: When creating a grid strategy, the price interval of each grid of the arithmetic grid is equal (for example, 1, 2, 3, 4).

Grid mode-Geometric: When creating a grid strategy, the price range of each grid of the geometric grid is proportional (for example, 1, 2, 4, 8).

Explanation of order parameters

- Investment: The amount of mortgage assets invested when the Margin Grid bot is created

- Total profit: Grid profit + Unrealized profit

- Grid profit: Bots buy low and sell high and profit from arbitrage

- Unrealized profit: (Current price-position purchase cost) * number of bot tokens held

- Grid annualized: [(Grid profit/Investment)/(Lasting time/365)]*100%

- Total annualized: [(Total profit/Investment)/(Lasting time/365)]*100%

At present, the leverage setting supported by the Margin grid are 0.2X, 0.5X, 1X, 2X, 3X, 4X, and investors can choose different leverages according to their risk tolerance. When the parameters are set, you can see the current estimated liquidation price before opening an order, which means that if the currency price reaches the liquidation price, your grid order will be automatically closed and your mortgage assets will be liquidated. Please be careful.

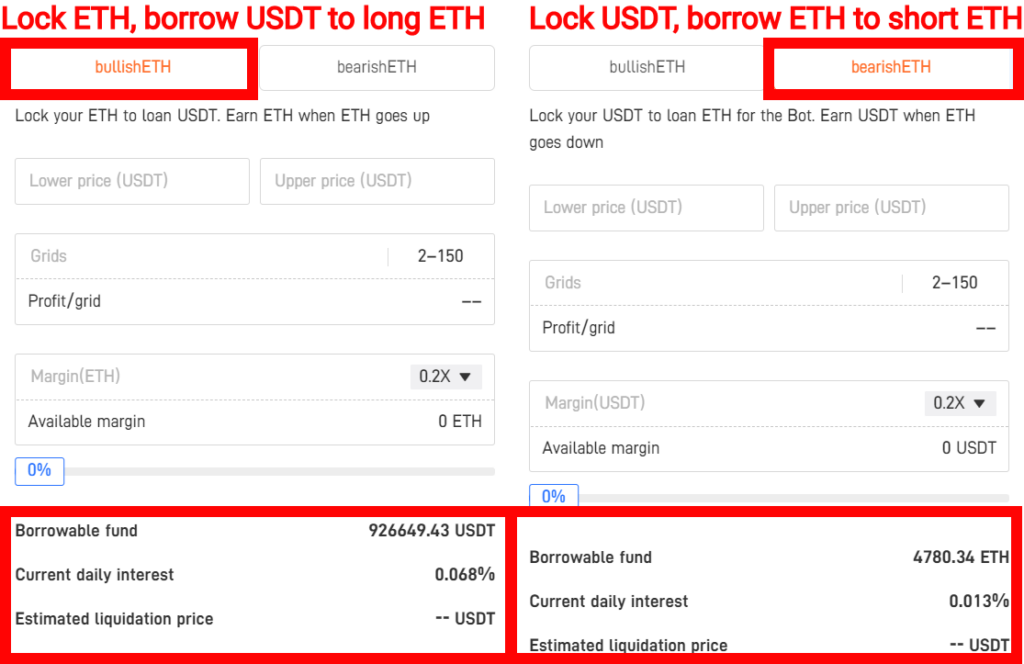

Two models of Margin Grid

Lock your tokens to loan USDT

This mode is to lock your tokens to loan USDT. For example, to create the ETH/USDT trading pair Margin grid, you need to mortgage the your ETH to loan USDT. The total loanable amount will be based on Leverage multiples and mortgaged asset prices.

Lock your USDT to loan tokens

This mode means that the USDT you hold will be mortgaged to borrow tokens. For example, to create the ETH/USDT trading pair Margin grid, you need to mortgage the your USDT to borrow ETH, and the total loanable amount will be It is calculated based on the leverage multiple and the value of the mortgaged asset.

Precautions

- To create a Margin Grid, you need to pay a certain amount of interest. The calculation method of interest will be calculated based on the daily interest rate in the current market (the daily interest rate is floating, determined by the supply and demand relationship between the borrower and lender, and will be updated once a day)

- Another parameter that the Margin Grid needs to pay attention to is the liquidation price. When the currency price drops to the estimated liquidation price, the bot will automatically close. In addition, the grid profit generated during the operation of the Margin Grid will be automatically added to the margin to prevent the botís order from being liquidated due to insufficient margin. At the same time, you can manually add the margin to reduce the liquidation price. When the currency price triggers the liquidation price, you will lose your investment and margin.

I don't really understand the difference between the Leveraged Reverse Grid Bot and the Margin Grid Bot short.

I would appreciate it if you could tell me the advantages and disadvantages of each.